Hi guys!!!!!

It’s been a long time since we’ve caught up. Life has been hectic and your girl has been fighting the good fight. But I’m back and I have some exciting news about a project I have been working on.

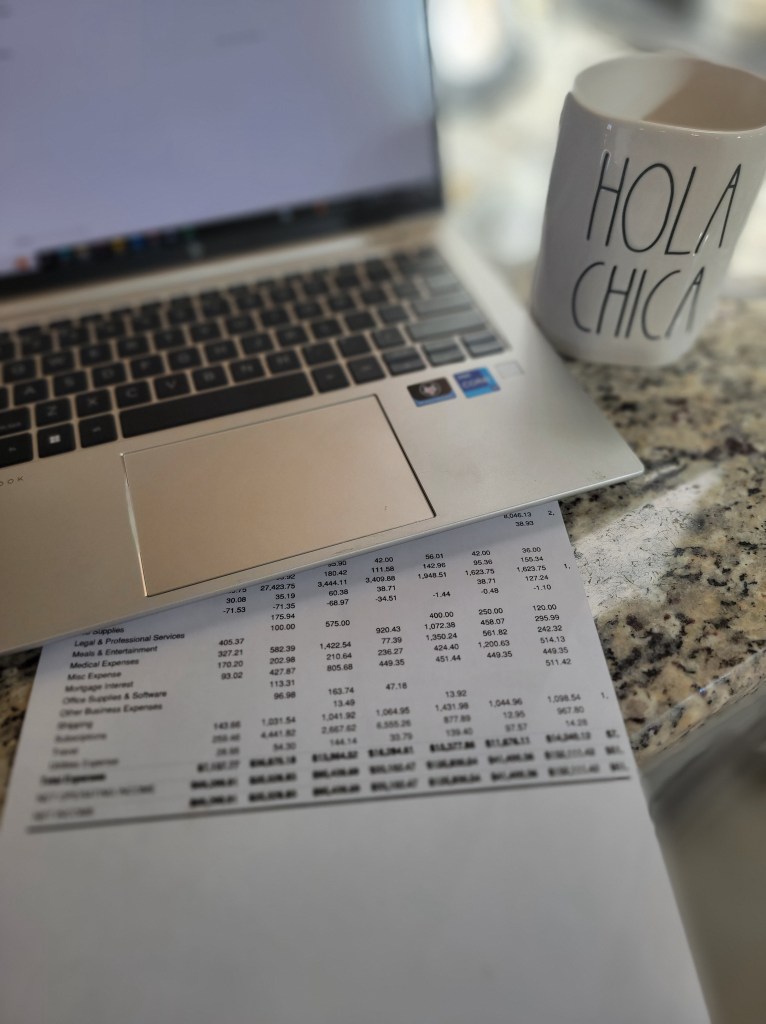

I have created two planners; Boss Lady Financial Planner & Boss Lady Budget Planner; that are available for purchase on Amazon. These planners are for all my Boss Ladies who are looking to be more organized in the coming year and take charge of their financial wellness. Your girl is published and feeling pretty proud about it.

Boss Lady Financial Planner is for Women Entrepreneurs. It allows them to create a 12 month financial plan so they can set realistic goals and compare those goals to their actual results. This planner helps women entrepreneurs focus on the financial side of their business and work towards growing their revenue.

Boss Lady Budget Planner is for women who are looking to be more financially responsible and improve their financial health. The first step to improving your relationship with money is to have a budget. In the Boss Lady Budget Planner you can create a 12 month budget and compare it to your actual spending habits to keep yourself accountable.

As we take inventory of 2023, I’m sure there are ways we could’ve all done a better job of managing our finances. As we go into the new year let’s take the steps we need to improve our financial health. Grab your copy of Boss Lady Financial Planner and Boss Lady Budget Planner today!!!!

Happy New Year!!!! Let’s make it a great one!